Car Crash Scamming Now a Crime

Motor Vehicle Accident Lawyers

Following a car crash it's advisable to seek advice from qualified motor vehicle accident lawyers, if you are considering making a claim for compensation.

You may need to develop a long-term relationship with your lawyer, so research is important and a lawyer offering free initial advice is helpful.

In most instances the driver at fault will have CTP (Compulsory Third Party) Insurance, which is included as part of vehicle registration costs in Queensland.

Stallion Lawyers

Respected Motor Vehicle Accident Lawyers may offer 'No Win, No Fee' services where they will not take payments or require any professional fees unless or until they obtain a successful settlement of your matter.

Even if you feel fine now, it's possible that car crash injuries like whiplash can appear days or weeks after an accident.

Car Crash Scammers

Unfortunately, scammers pretending to be lawyers or 'wanting to assist' you to gain compensation for injuries following a car crash, may phone you to obtain your personal details and then sell this information to 'injury lawyers' to make money out of your situation.

Scammers may get your phone number and personal details through a variety of sources, including online booking systems, competitions and surveys, or through people sharing data that they aren't supposed to share.

Compulsory Third Party Insurance Claims

The Motor Accident Insurance Commission (MAIC) is the regulatory authority responsible for the ongoing management of Queensland's Compulsory Third Party (CTP) insurance scheme.

CTP insurance protects motor vehicle owners and drivers from being held financially responsible if they cause injury to someone else in a motor vehicle crash. It also provides appropriate compensation, treatment and rehabilitation to people who are injured in motor vehicle crashes through no fault of their own.

If you have been injured in a motor vehicle accident, which was not your fault, then you may be able to claim compensation. This includes accidents in which you were the driver, passenger, cyclist or a pedestrian.

CTP Insurance also includes instances where the vehicle at fault is uninsured or unregistered. Furthermore, non-citizens and non-residents are still entitled to claim injury compensation in Australia.

In the past, car crash scammers have targeted over 1.5 million Queenslanders with aggressive and relentless phone calls about injuries from car crashes that may be covered by CTP Insurance.

Scammers have targeted vulnerable people to profit from selling their personal information. Queenslanders have reported receiving five to 10 calls a week and even two to three calls a day.

A Crime in Queensland

The Motor Accident Insurance Commission has now taken firm action to stop car crash scammers. In consultation with industry stakeholders, MAIC developed legislative changes to make car crash scamming illegal.

The Motor Accident Insurance Commission has now made it illegal for people to call you or harass you for your personal information and sell it for a profit. It is also against the law to pay someone for a claim referral.

Car crash scammers now face penalties of up to $40,000 for an individual and $200,000 for a corporation for harassing Queenslanders and breaching their privacy.

If you've been contacted by a car crash scammer, hang up and report them to MAIC online or call 1300 302 568.

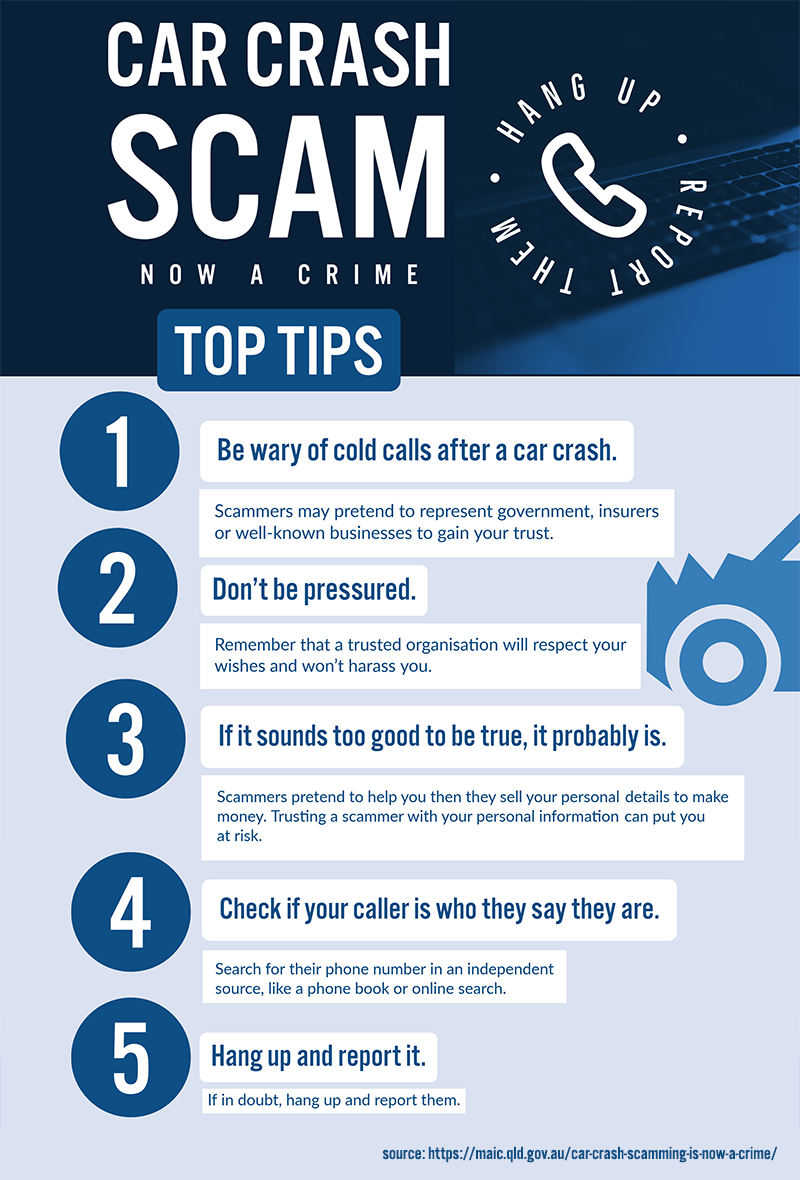

Top tips

1 Be wary of cold calls after a car crash.

Scammers may pretend to represent government, insurers or well-known businesses to gain your trust.

2 Don't be pressured.

Remember that a trusted organisation will respect your wishes and won't harass you.

3 If it sounds too good to be true, it probably is.

Scammers pretend to help you then they sell your personal details to make money. Trusting a scammer with your personal information can put you at risk.

4 Check if your caller is who they say they are.

Search for their phone number in an independent source, like a phone book or online search.

5 Hang up and report it.

If in doubt, hang up and report them to us.

https://maic.qld.gov.au/car-crash-scamming-is-now-a-crime/

Researched, Compiled, Composed, Written and Edited by Dr Steve Gration – July 2020

SEARCH ARTICLES

advanced search tips examples: "Yoga Meditation" Therap* +Yoga +MeditationRecent Posts

Nov 27 2025

The Psychology Behind the Primacy Effect

Jun 24 2025

Microplastic Exposure: Bottled Water vs Tap

Jun 09 2025

Squats for aligning hips

Apr 29 2025

Creative Thinking

Jan 28 2025

How to talk to someone you disagree with

Jan 27 2025

Alcohol Causes Cancer

Jan 14 2025

The role of the Amygdala

Oct 04 2024

A Support Guide for Anorexia Nervosa

Jun 25 2024

Sleep better