How healthy are your business practices?

Lodging and paying your Business Activity Statement (BAS) on time is important to run a successful business.

Most businesses lodge quarterly but how often you lodge will depend on your circumstances.

Use ATO online services to lodge quickly and securely, you may be eligible for an extra two weeks to lodge and pay.

Even if you have nothing to report, you must still lodge a nil statement.

A registered tax or BAS agent can also lodge on your behalf.

Part of our process is also letting you know, on a monthly basis, how much you owe the ATO ahead of time.

Jeannie Bookkeeping Gold Coast

To avoid potential charges and penalties your must also pay your BAS on time.

Businesses that make a pre-payment using BPAY or bank transfer in advance of an expected bill, find it easier to manage their tax.

If you think you'll have difficulty paying your BAS on time, it is important to call 13 11 42 to avoid penalties.

Usually, if you can't pay by the due date, you can enter into a payment plan.

You must still lodge your BAS even if you are having trouble paying.

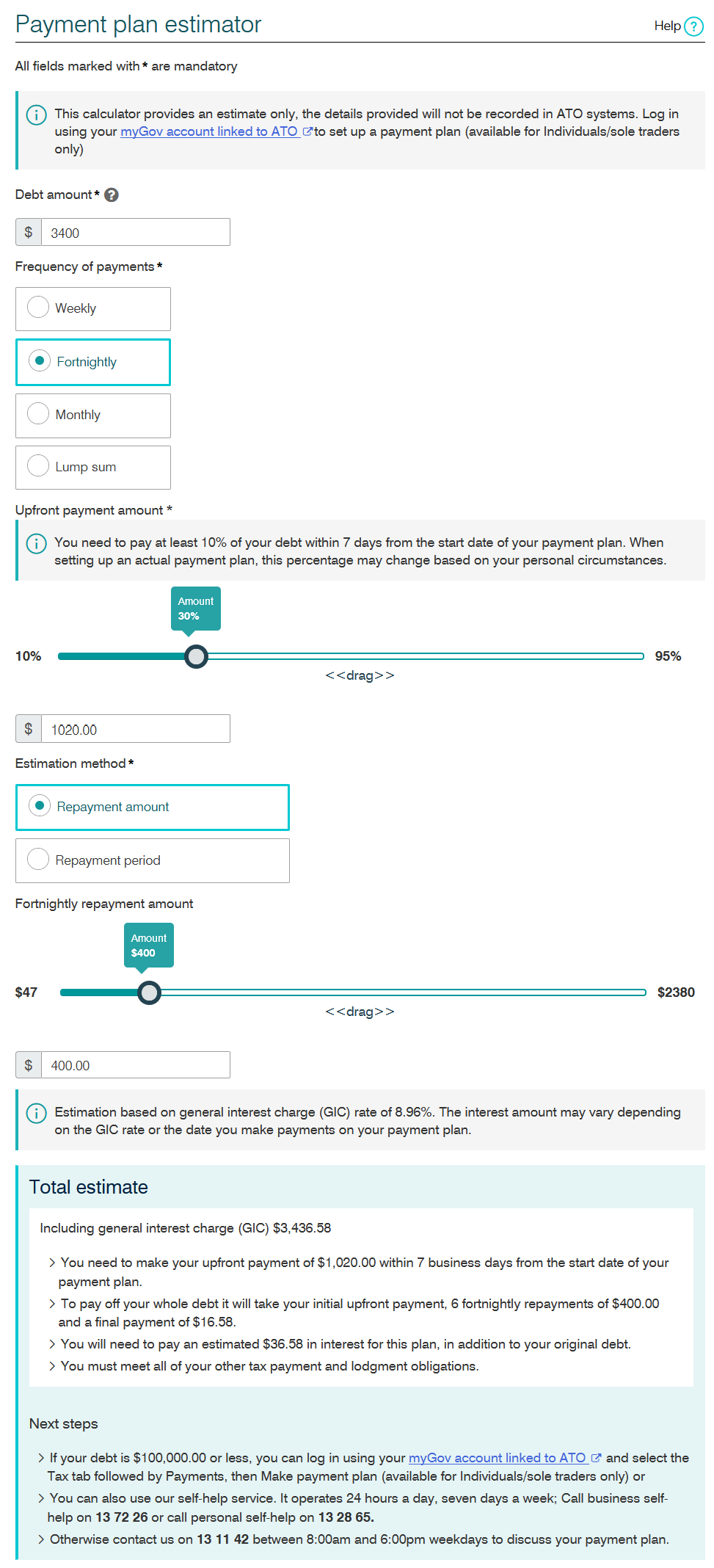

ATO Payment Plan Estimator

The ATO have online payment plan estimator to work out a payment plan you can afford. You can also use it to find out how quickly you can pay off a tax debt and how much interest you’ll be charged.

In the example below it calculates the payments required if you owed $3400 and could afford $400 per fortnight to pay it off.

Financial Advice Including Tax Planning

You can get specific financial advice on Tax Planning and Cash Flow Management

Read a related article Break-even Analysis for Bookkeeping which discusses the useful break even analysis formula.

A financial formula sure beats a work long hours and hope it works out formula

How much to charge for goods and services

The psychology of pricing services and products can make or break your business. As a Gold Coast Painter says "you make your money by how you quote".

How to set your price points may depend on whether you want to attract "bargain hunters" or "value seekers". Even the number of price points you have can turn "bargain hunters" in to "value seekers".

Property Investment

Less than 6% of Australians, or roughly 1.3 million people, own an investment property, even though property is a national past-time according to Fox's Southport Real Estate Agents.

Another point well made is understand your attitude to risk. Financial planners will offer a risk profiler. The type of questions used are designed specifically to understand your attitude to risk.

SEARCH ARTICLES

advanced search tips examples: "Yoga Meditation" Therap* +Yoga +MeditationRecent Posts

Nov 27 2025

The Psychology Behind the Primacy Effect

Jun 24 2025

Microplastic Exposure: Bottled Water vs Tap

Jun 09 2025

Squats for aligning hips

Apr 29 2025

Creative Thinking

Jan 28 2025

How to talk to someone you disagree with

Jan 27 2025

Alcohol Causes Cancer

Jan 14 2025

The role of the Amygdala

Oct 04 2024

A Support Guide for Anorexia Nervosa

Jun 25 2024

Sleep better